Asset management is under pressure. Margins tightening, revenue becoming less predictable, and costs stubbornly high. In that environment, AI is emerging not just as a “nice to have,” but potentially a cost lever of first magnitude.

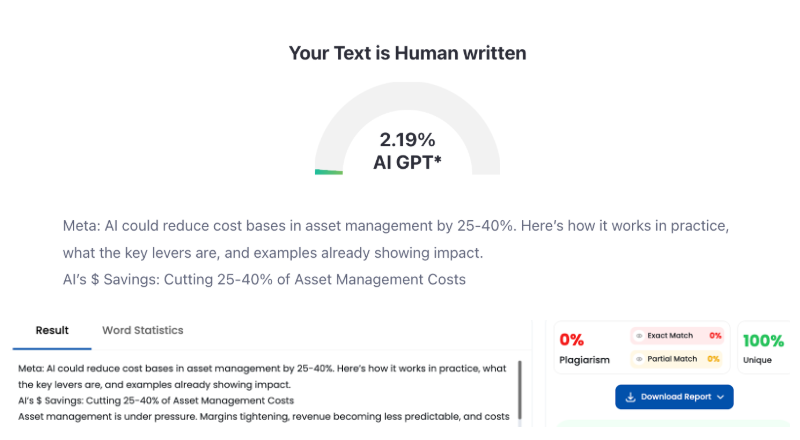

Studies suggest that AI (especially generative AI and agentic models) could eliminate 25-40% of the cost base in a typical asset manager. But how realistic is that, and where will those savings come from?

We ran through the research, looked at public examples, and broke down which levers matter most.

Setting the Stage: Why AI Matters Now

Over the past decade, asset managers have poured money into systems and data. Yet productivity gains have lagged. Many firms spend 60-80% of their tech budget just running existing systems (maintenance, legacy support).

McKinsey notes that in today’s environment:

- Margins have shrunk — North American firms lost ~3 percentage points; European ones ~5 points over five years.

- Technology investments have grown fast, but often with limited return because many investments go to “run the business” rather than transformational AI.

Still, McKinsey sees AI as one of the only levers with potential to disrupt cost structure meaningfully. They estimate that the “AI / GenAI / agentic AI” wave could touch 25-40% of a firm’s cost base by automating distribution, investment processes, compliance, and accelerating dev cycles.

Also, in their “AI’s edge in asset management” visual summary, they highlight use cases like portfolio manager copilot agents or code copilots as high-impact though relatively easier to implement. Some AI companies, like S-PRO, already have successful client cases to be proud of.

The Key Levers of Cost Reduction

To see how AI might cut costs, we need to look at where dollars are spent today. The main categories are:

- Middle & Back Office Operations

- Reconciliation, trade settlement, data cleanup, validation tasks.

- AI / automation can accelerate or eliminate manual touchpoints.

- Workflow agents can route exceptions, parse documents, automate routine corrections.

- Distribution / Client Acquisition

- Many firms spend heavily on marketing, client onboarding, reporting, RFP preparation.

- AI tools that generate pitch decks, personalize outreach, or automate reporting help compress costs.

- Research & Investment Process

- Analysts spend time gathering data, cleaning it, summarizing findings.

- Copilot agents, natural language query interfaces, and models that pre-summarize data or propose hypotheses can cut hours per person.

- Software Development & Engineering

- AI-assisted coding, test generation, and automation reduce dev cycles.

- Firms can reallocate engineering effort away from boilerplate to higher-ROI features in software to manage investments.

- Compliance, Reporting & Risk

- Rule-checking, audit trail generation, regulatory filings are heavy cost centers.

- AI systems can flag anomalies, generate documentation drafts, cross-check against rules.

By tackling these domains, a firm can compound savings. But the 25-40% number doesn’t come from a single department — it’s a portfolio of savings.

Concrete Example: Trading Cost Savings

One notable example: Norway’s sovereign wealth fund (the world’s largest) aims to cut ~$400 million annually in trading costs using AI. Their annual trading expenses hover at ~$2 billion.

They claim ~$100 million in initial savings already by optimizing timing, reducing unnecessary rebalancing triggered by index changes, and internalizing flow prediction.

That alone is ~20% of the trading cost line, before touching research, operations, or distribution.

What It Takes to Realize Those Savings

Savings don’t happen by flipping a switch. Here are the enablers:

- Strong data foundation: Clean, unified data is a prerequisite. No AI model can compensate for broken pipelines.

- Governance & oversight: When AI influences decisions or process flow, auditability, explainability, rollback paths matter.

- Scalable architecture: Real-time inference, model serving, feature stores, observability.

- Change management: People resist automation. Shadow runs, phased rollout, feedback loops are crucial.

- Talent & tools: Asset managers must combine domain knowledge with AI capabilities — either build or partner with firms skilled in AI in finance.

McKinsey also signals that transformations must align business and IT, reduce custom fragmentation early (fit-to-standard), and establish a global operating model to avoid duplicated, costly local patches.