Do You Make These Common Lending Mistakes?

We all tend to take out various lending solutions from time to time. It’s almost impossible to live your life without getting a mortgage or having at least one credit card. On the other hand, not many consumers are aware of common lending mistakes or how to form useful credit habits so that their personal finances improve in the long run.

People take out so much debt these days. The recent data from Experian indicates that the average total debt per person is $92,727 in the USA in 2021 while it’s combined with student loans, mortgages, car loans, and other debt payments.

If you want to avoid widespread mistakes and strive for a better financial future, you need to consider the following tips. Keep on reading to find out about the importance of being attentive when you request a loan and what to do if your credit was damaged.

The Importance of Being Very Attentive While Taking Out Loans

Before you even think of taking out a lending solution, you need to understand your responsibility. It’s significant to be attentive and know everything about the loan you are about to take out.

Generally, there are two types of loans – secured and unsecured ones. Secured loans require collateral to back them up. It may be your auto, house, or any other valuable asset that you can risk losing in case of a default.

Unsecured lending solutions don’t demand any collateral and are often easier to obtain through the interest rates vary among lenders. Do you want to know what apps let you borrow money instantly? You may also search for such apps and online tools and have a chance to fund your immediate money needs from the comfort of your home.

9 Mistakes While Taking a Loan People Tend to Avoid

Let’s talk about the top 9 mistakes people make when they take out a loan. If you try your best to avoid them you will maintain a healthy credit history and a decent credit rating and have more lending options next time you urgently need additional funds.

1. Being Unaware

The very first mistake is to forget about having debt. It’s so convenient to use a credit card instead of paying with cash. In the long run, you may forget about the total cost of spending.

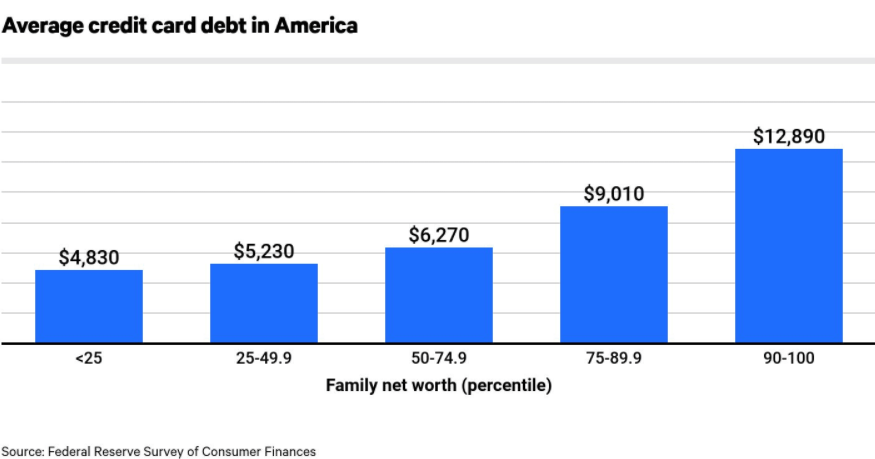

Do you know that the average credit card debt is currently $5,315 per person in the USA? If you don’t handle your money physically it doesn’t mean you don’t spend it each month. Try to avoid this widespread mistake and have some cash set aside in envelopes. Once you run out of them you will try to refrain from spending more funds or using a credit card.

2. Paying Just The Minimum

This is the second biggest mistake consumers make when they have one or several credit cards. Although credit card providers persuade you that it’s normal to make just your minimum monthly payment which can be about 2%, you should think twice.

After all, providers of credit cards worry only about their income. If you keep on paying only the minimum the interest will accrue over time so you end up paying more.

3. Spending Spree

There are plenty of things we want to have but can’t afford to. Many people look at others and want to purchase things that other people have. However, you should ask yourself whether you really need those things.

You may purchase something on credit just to keep up with your friends or colleagues but then you will need to pay the debt off for quite a while. Our Credit Sesame review will let you check your current debt-to-income ratio. The tool will also break down your debts by category and let you know how much you can afford to pay each month. Of course, it’s much better to set some cash aside each month until you can afford to make this purchase yourself. It’s much better to set some cash aside each month until you can afford to make this purchase yourself.

4. Forget About Your Long-Term Goals

Many consumers forget about their financial aims and start wasting money on unnecessary things. It’s hard to avoid impulse spending and tell your brain that you have more important goals for the future.

However, if you write down your long-term financial goals and keep them in mind each time you feel a temptation to spend some cash, you will be able to resist temptation. Don’t purchase another pair of new shoes. Focus on repaying existing debt instead.

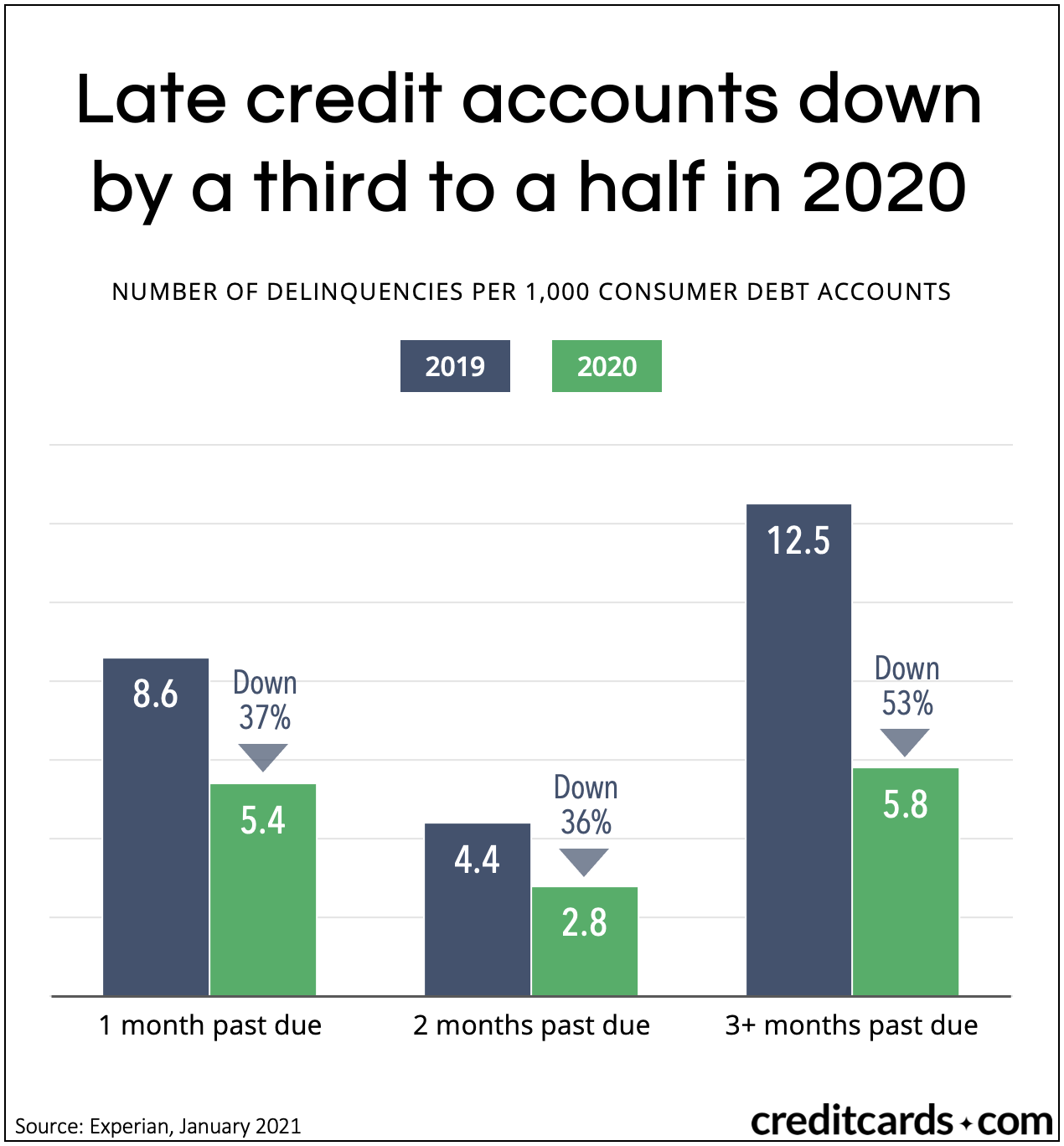

5. Being Late on Payments

Another common mistake is to forget about your credit obligations. You shouldn’t forget about payments being due as it may lead to late fees and additional charges. As a result, you will have to pay more in the long run and spend more money on debt repayment. Set up automatic payments instead so that you make on-time credit payments each month.

6. Accepting the First Offer

We all want to have cash. Shopping around to find the best credit deal is time-consuming. So, many clients prefer to accept the first lending offer and sign the contract or get the first credit card they are offered. On the other hand, if you take some time and compare terms and rates you will most likely find a better contract.

7. Not Requesting Free Credit Reports

Did you know that you may request a free annual credit report? You may not know why you should ask for one. Well, this credit report is one of the most important documents that creditors review before they make their lending solution to approve your loan application.

Sometimes, credit reports contain errors that may damage your credit rating. So, it’s worth requesting this paper from three credit reporting agencies.

8. Having No Credit

Do you know what is being “credit invisible”? It means you have no credit history at all. Recent graduates and some other people who have never taken out a loan or a credit card are called credit invisible. You need to act at once. Start building your credit history by taking out a small loan or opening a credit card account.

9. Focusing on Too Much Debt

If you have several loans or credit cards, it’s a common mistake to concentrate on all of them at once. There are useful techniques for getting rid of existing debt in this case. You may try an avalanche method. It means you should tackle the highest-interest debt first.

Once you repay it you move further to the lower-interest debt until you tackle each loan and become debt-free again.

What to Do If Your Credit Score Was Hurt

If you had some problems with debt repayment and your credit score was damaged you may want to rebuild it. In this case, you may take out another loan and make on-time payments so that your rating boosts.

Paying your bills on time each month is essential if you want to improve existing credit. Once you pay down your current debt your rating will rise and you will be able to qualify for better lending offers and lower rates in the future.

In conclusion, it’s significant to avoid common lending mistakes and form useful financial habits that will help you achieve your monetary goals.

Also Read: Loan Lending App Development In A Few Easy Steps