A passing fad, a scam or a genius investment, no matter what you call cryptocurrencies, it is currently one of the biggest investment markets around the world. When Bitcoin first entered the market, it was under heavy speculation with many people thinking it might tank, but with it’s success – it has opened the market for many people to start investing in other cryptocurrencies that are known as altcoins.

One of the major reasons of investing in Bitcoin and other cryptocurrencies is the monetary value, since currently, 1 bitcoin is roughly equivalent to US$8500. This allows people to invest in cheaper cryptocurrencies and sell them off for a higher price.

With Bitcoins already at unreachable heights, other cryptocurrencies are also trying their luck at emulating bitcoin’s success. In this article, we’ll take a look at the 10 different cryptocurrency alternative that you can invest in. But before we delve right into the different cryptocurrencies available on the market, let’s talk a bit about cryptocurrencies.

Read More: – 6 Techniques for a Successful Cryptocurrency Marketing Strategy

How Cryptocurrencies Differ From Traditional Currencies

Traditional currencies such as dollars or euros are issued by the central banks of the different countries. The most important characteristic of conventional currency is that it is centralized, which means they are controlled by an agency or a department, commonly the central bank of the country it is being used in. So, in case of any significant problems with the currency, the government will take responsibility for it.

On the other hands, Cryptocurrencies are electronic and digital currencies. They use a ‘blockchain’ mechanism, which means that each transaction made using the currency is permanently recorded in a single encrypted ledger. These currencies are not controlled by any single entity and are mined through programs on the internet. There is no middle man and the way the currency is designed – it cannot be duplicated, manipulated or forged.

Read More: – Cryptocurrencies – Are They The Right Investment For The Future?

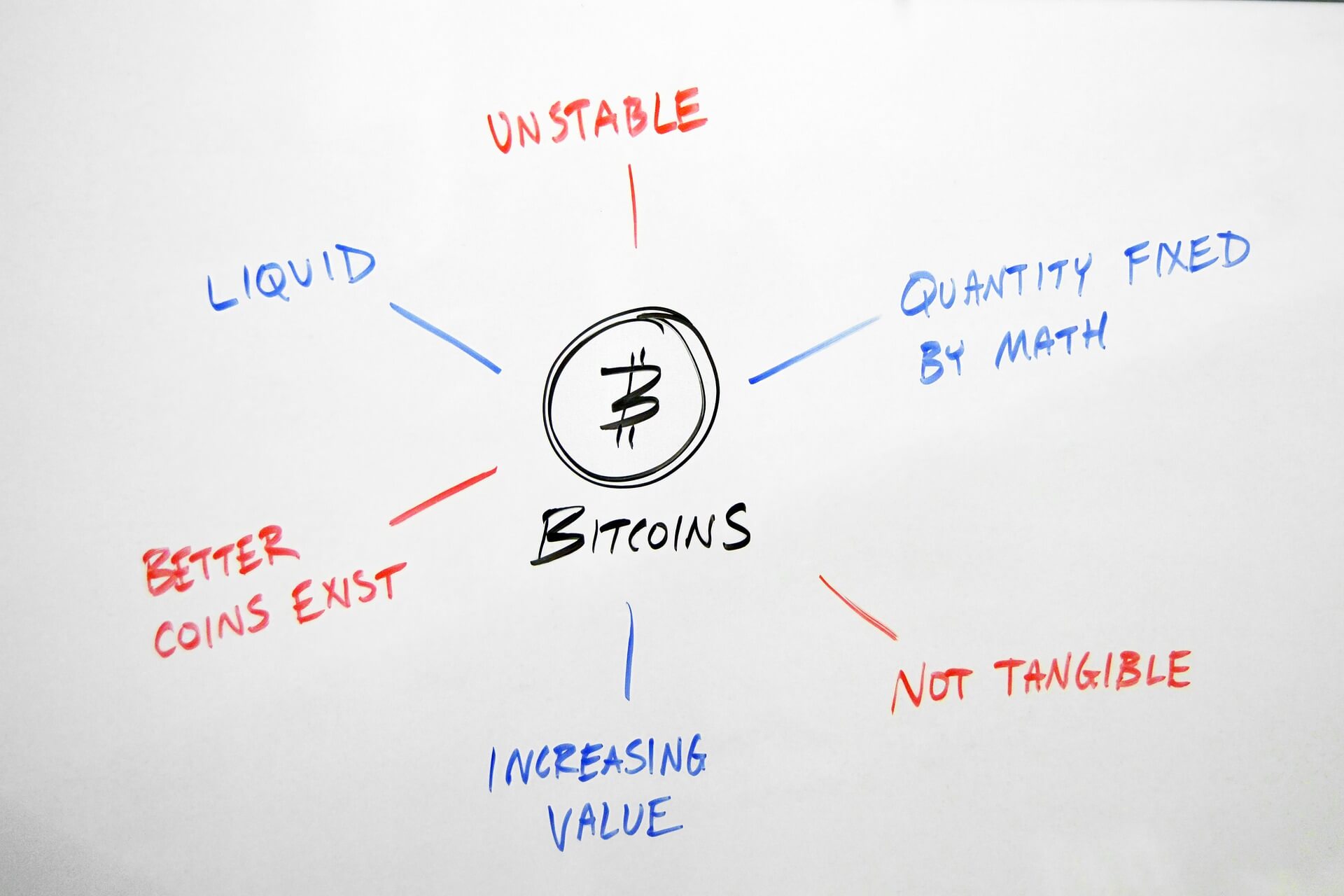

Advantages of Cryptocurrencies

There are many advantages to using cryptocurrencies:

- Security – Cryptocurrencies are digital and each transaction is encrypted with NSA created cryptography, it becomes much harder to steal, compared to a wallet full of cash. Also, since they are not printed, cryptocurrencies are also harder to counterfeit.

- Universally Recognized – Cryptocurrencies are universal, especially since they work on the internet and don’t require converting form currency to currency depending on the company. No matter in which country you use the currency, the value remains the same.

- No Fees – Using traditional currency comes with a number of different fees and takes, such as conversion fees, transferring fees, and so on. However, with cryptocurrencies there is no requirement of conversions, so you are exempt from having to pay these fees. Also, cryptocurrencies can be transferred directly from wallet to wallet, so you don’t have to worry about having to pay any banking fees.

- No Middlemen – Cryptocurrencies are directly transferred from owner to another, which means no banks, or any other transfer and exchange services, which results in having zero middlemen that can make money from the transfer.

- Decentralization – Cryptocurrencies are maintained jointly using blockchain technology. Blockchain is basically a consolidated ledger that maintains permanent records of transactions. Since, this blockchain is maintained by multiple people across multiple networks and not just one central authority, it becomes much harder to duplicate, manipulate or forge the entries made using cryptocurrency.

Disadvantages of Cryptocurrencies

While there are many benefits to cryptocurrencies, there are also a few downfalls of using it:

- Irreversible – Once a transaction is made, it is irreversible; which means once the money has been deducted from your wallet, it cannot be canceled.

- Complicated – The concept of understand blockchain and how cryptocurrencies work is not easy. It requires a lot of technical knowledge, especially when it comes to mining crypto coins, building and securing your wallet and so on. Without this technical know-how, cryptocurrencies are more troublesome than they seem.

- Prone to Hacking – With the lack of knowledge and a steep learning curve, users end up opening themselves up to hackers. Hackers are also more keen on targeting cryptocurrency wallets as the value of these currencies are constantly on the rise.

- Volatile – Since the currencies are not controlled by any institution, the value of the currency is constantly on the fritz depending on the availability of the coin. The more coins that are mined, the value drops and vice versa. For example, Bitcoins recently reached the value of US$15,000 before tumbling exceptionally quickly.

- Not accepted widely – Because of their volatile nature and lack of backing by a financial institution, many users are still not comfortable using this form of currency. This makes it difficult to integrate its usage in daily lives, which means you won’t be able to use this currency everywhere.

Read More: – Essential Tips for Keeping Up The Cryptocurrency Trends Of 2018

10 New Cryptocurrencies to Watch Out For in 2018:

1. Litecoin (LTC)

Litecoin was introduced as a peer-to-peer currency by former Google employee Charles Lee, who created Litecoin as an alternative to Bitcoin. The benefit of Litecoin is that it processes a block ever 2.5 minutes, making it faster in terms of processing transactions, making it faster than Bitcoin.

2. Ethereum (ETH)

Unlike Bitcoin which was primarily designed as a currency, Ethereum was developed as a “world computer” super network to help build apps that won’t require third-party companies. It also executes peer-to-peer smart contracts. It offers developers a distributed platform where miners earn ether to fuel the network. In 2016, following the collapse of the DAO project, Ethereum was split into two separate blockchains, Ethereum and Ethereum Classic.

3. Stellar (XLM)

Steller is an open source protocol for exchanging money between different platforms. Founded in early 2014, Steller introduced an easier, faster and a more efficient way for transferring money across borders. Steller’s cryptocurrency is named Lumens which are currently growing on the ranks of cryptocurrency.

4. NEM (XEM)

The NEM platform is a distributed blockchain and cryptocurrency. The platform is designed as a server infrastructure and client based on Java and Javascript. It was coded as an improved version of the bitcoin blockchain and targeted improved scaling and speed of mining.

5. Ripple (XRP)

Ripple was designed as a real-time gross settlement system for fiat money (currencies that are backed by the government), cryptocurrency, commodity, and other units of value such as frequent flier miles, etc. It was created on a distributed open source internet protocol, consensus ledger and native cryptocurrency. Ripple offers a faster and reliable alternative to other cryptocurrencies such as bitcoins.

6. NEO (NEO)

NEO is a blockchain platform that facilities the development of digital assets and smart contracts. It uses a delegated Byzantine Fault Tolerance (dBFT) mechanism that can support to 10,000 transactions in a second.

7. Cardano (ADA)

Cardano is another platform that utilizes a decentralized blockchain system to help developers a smart contract platform. Founded by Ethereum co-founder Charles Hopkinson in 2015, it sets itself apart by being the first platform to be maintained by an international group of scientists and academics that specialize in blockchain technology.

8. Iota (MIOTA)

Iota uses an innovative new blockless distributed ledger that stores transaction in a directed acyclic graph (DAG) structure, called a Tangle. It is scalable, lightweight and allows transferring of any value without any fees. Unlike the bitcoin blockchain, each transaction in Tangle confirms previous transactions on the network, allowing microtransactions without extra fees.

9. Monero (XMR)

Monero focuses on privacy and uses a combination of stealth addresses and ring signature technology to make transactions secure, private and untraceable. Any transactions made on the Monero blockchain are untraceable, making it lucrative for several advocates of citizen privacy.

10. Dogecoin (DOGE)

Dogecoin was originally introduced as a “joke currency” inspired from the Doge meme on the internet. However, from there it developed it’s own online community. It is now a decentralized, peer-to-peer digital currency that is commonly used for tipping each other. Compared to other cryptocurrencies, Dogecoin has a faster production rate.

With the cryptocurrency boom, the number of different cryptocurrencies on the market are vast. This list just mentions a few of the many different cryptocurrencies that exist. With Bitcoin already out of reach for many people, these growing currencies are definitely something you can look into for investment. If you have any other currencies that you think should be on this list, please let us know in the comments section below.